do nonprofits pay taxes on rental income

Withholding from your pay your pension or certain government payments such as Social Security. Making quarterly estimated tax payments during the year.

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

All corporations can file their annual income tax return Form 500 and pay any tax due using approved software products.

. Long-term capital gains tax rates are 0 15 20 or 28 with rates applied according. If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your Georgia homes value may be exempt from the school tax. Short-term capital gains are taxed as ordinary income with rates as high as 37 for high-income earners.

Certain Virginia corporations with 100 of their business in Virginia and federal taxable income of 40000 or less for the taxable year may qualify to electronically file a short version of the return eForm. Publication 527 includes information on the expenses you can deduct if you rent a condominium or cooperative apartment if you rent part of your property or if you change your property to rental use. Edgar Grier inherited a house from his mother that she had rented out for many years to the same tenant.

Report rental income on your return for the year you. If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. There are two ways to pay tax.

Rental Property as Investment. You generally deduct your rental expenses in the year you pay them. Taxes are pay-as-you-go.

The first Emergency Rental Assistance ERA1 program set aside 25 billion on December 27 2020 through the Consolidated Appropriations Act. To protect Americans from the loss of basic housing security due to the devastating impact of COVID-19 two emergency funding programs have been assisting households unable to pay rent or utilities. How to File and Pay Annual income tax return.

Rental ownership is an investment not a business if you do it to earn a profit but dont work at it regularly and continuouslyeither by yourself or with the help of a manager agent or others. This means that you need to pay most of your tax during the year as you receive income rather than paying at the end of the year. When to Report Income.

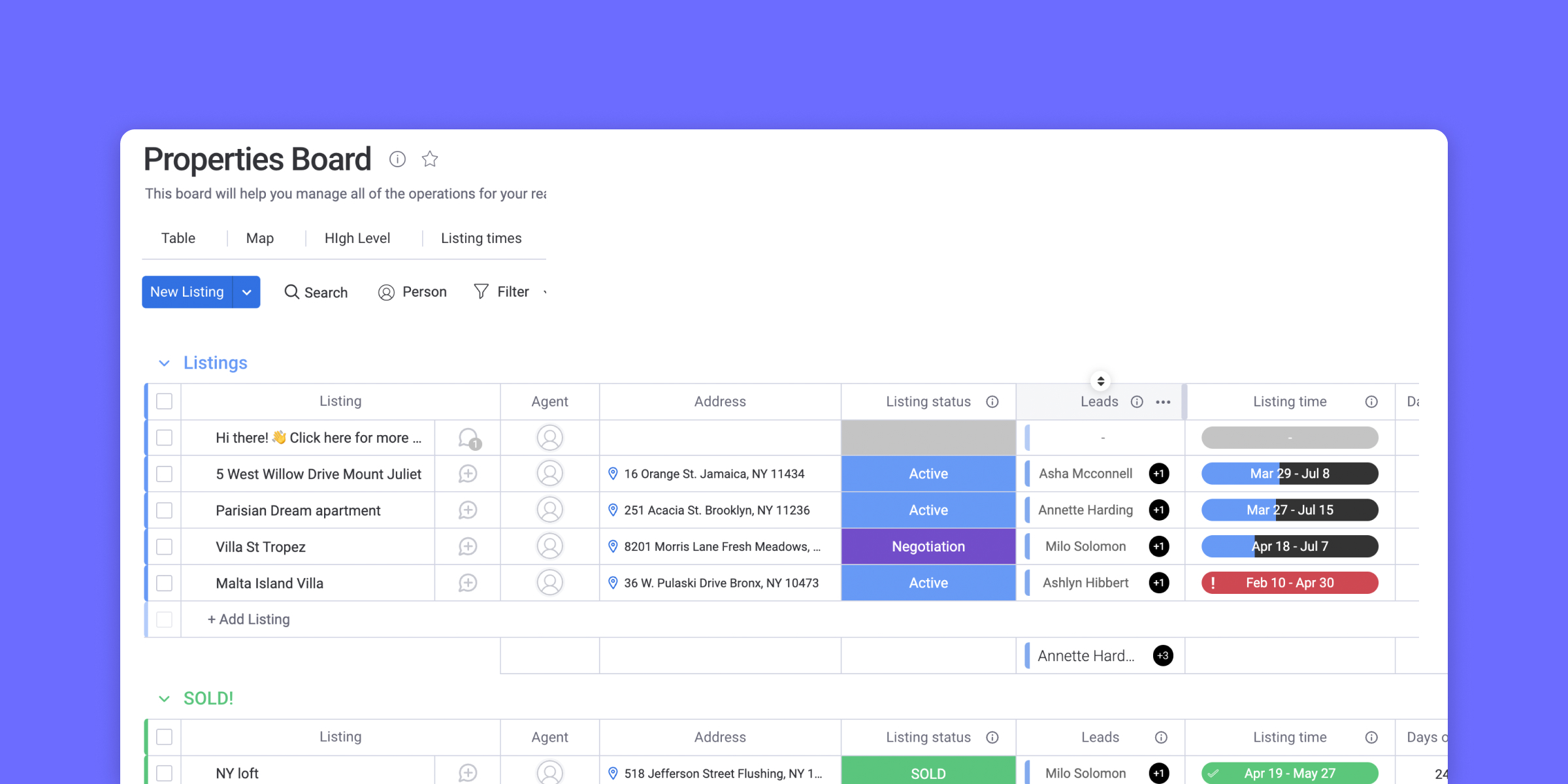

Best Rental Property Spreadsheet Template For Download Monday Com Blog

Property Management Tenant Monthly Rent

Accounting For Rental Property Spreadsheet Spreadsheet Probability Worksheets Budget Spreadsheet

Rental Property Management Template Long Term Rentals Rental Etsy Rental Property Management Rental Property Investment Property Management

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

Tax Information Nonprofits Renting Extra Space Church Facility Solutions

Free Blank Spreadsheet Templates Rental Property Management Property Management Spreadsheet Template

미국 주립대학 Uco의 Unofficial Blog 미국유학 유학비용 미국대학 주립대학 미국경영대 미국공대 미국대학편입 Map States Cost Of Living

Fundraising Infographic Fundraising Infographic The Nonprofit Sector In Brief Infographic Charity Foundation Nonprofit Startup Non Profit

Rental Income And Ubti A Look At The Irs Guidance To Its Auditors

Best Rental Property Spreadsheet Template For Download Monday Com Blog

Investment Property Flow Chart Infographic Template

How To Install Use Loyverse Pos On Your Computer Laptop Techforpc Com Software Apps Point Of Sale Retail Pos System

Reit Might Sound Intimidating At First But It S Really A Very Simple Concept Think Of It As A Mutual Investing Money Strategy Finance Investing

Beginner S Guide To Rental Income For Non Profits Taxable Or Not Blue Co Llc

Airbnb Rental Income Statement Tracker Monthly Annual Etsy Airbnb Rentals Rental Income Rental Property Management

Best Rental Property Spreadsheet Template For Download Monday Com Blog

The Ultimate 5 Property Rental Real Estate Template Excel Etsy In 2022 Rental Property Management Real Estate Investing Rental Property Rental Property Investment